Luxury Goods Sales Tax | Indonesia Tax Guide 2025 (23)

Indonesia

Luxury sales tax

2025-02-14 09:12:43

Page view:877

This issue's introduction

Tax payable

Chapter 4 Luxury Goods Sales Tax

Overview

Luxury goods are divided into two categories, namely motor vehicles and goods other than motor vehicles.

Taxable goods of luxury goods mean: they are not basic daily necessities; they are generally consumed by high-income people; they can show their status through consumption; they may harm health and social morality and disrupt public order.

The minimum tax rate of luxury sales tax is 10% and the maximum is 200%. However, the applicable tax rate currently ranges from 10% to 125% depending on the type of goods.

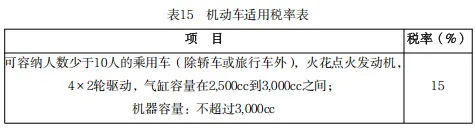

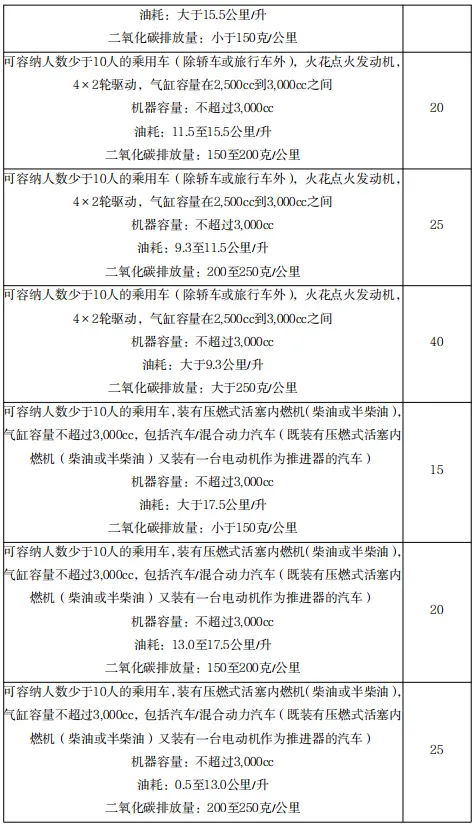

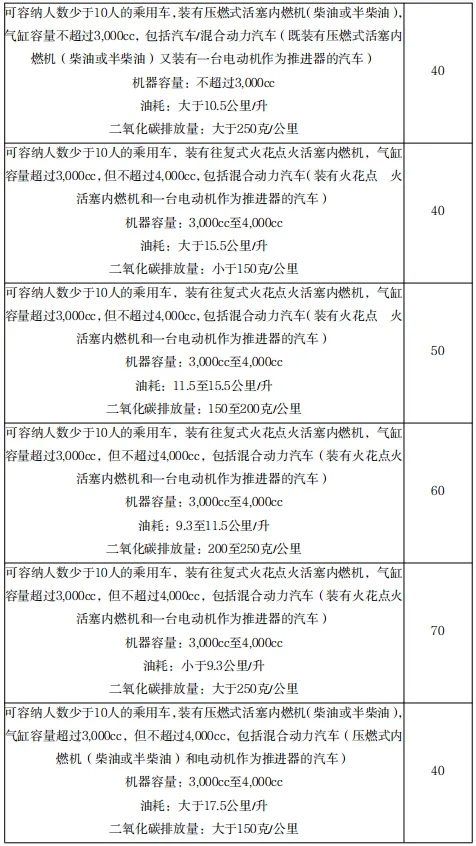

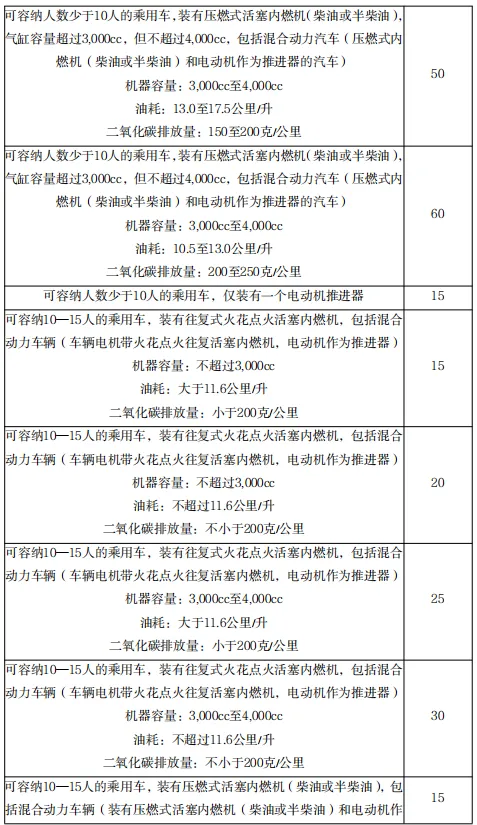

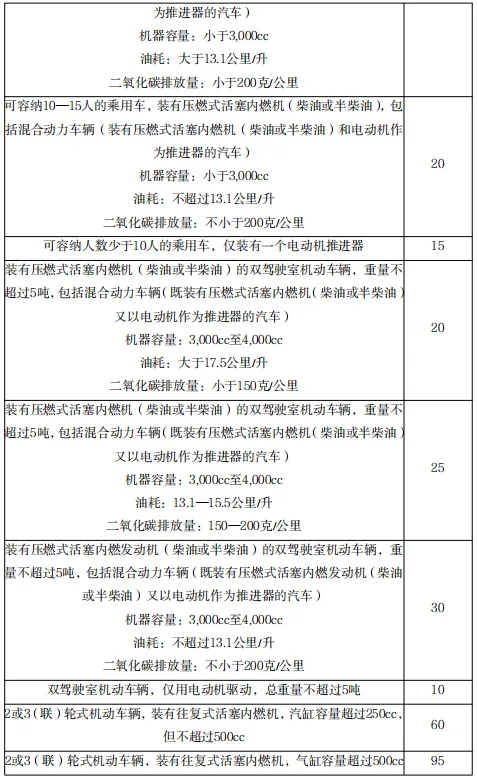

(1) The applicable tax rates for motor vehicles are as follows:

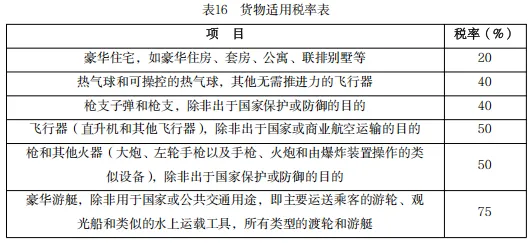

(2) The applicable tax rates for goods other than motor vehicles are as follows:

Tax payable

Luxury goods sales tax is only levied once at the production stage or import stage.

The collection of value-added tax and luxury goods sales tax should be calculated on an accrual basis, and the current income and expenses are recognized at the time when the right to receive cash or the obligation to pay cash occurs. For transactions conducted through e-commerce, the time when the tax obligation occurs is stipulated by special laws and regulations.

The excitement continues in the next issue...