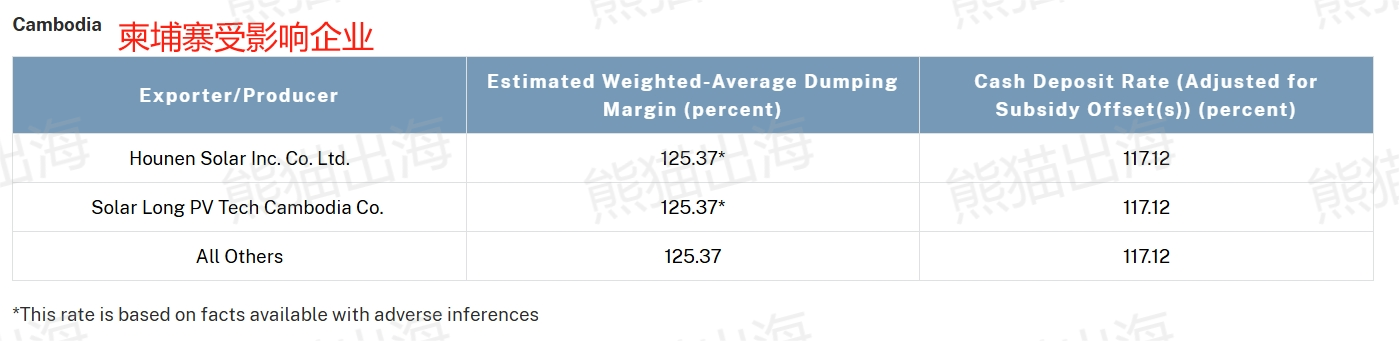

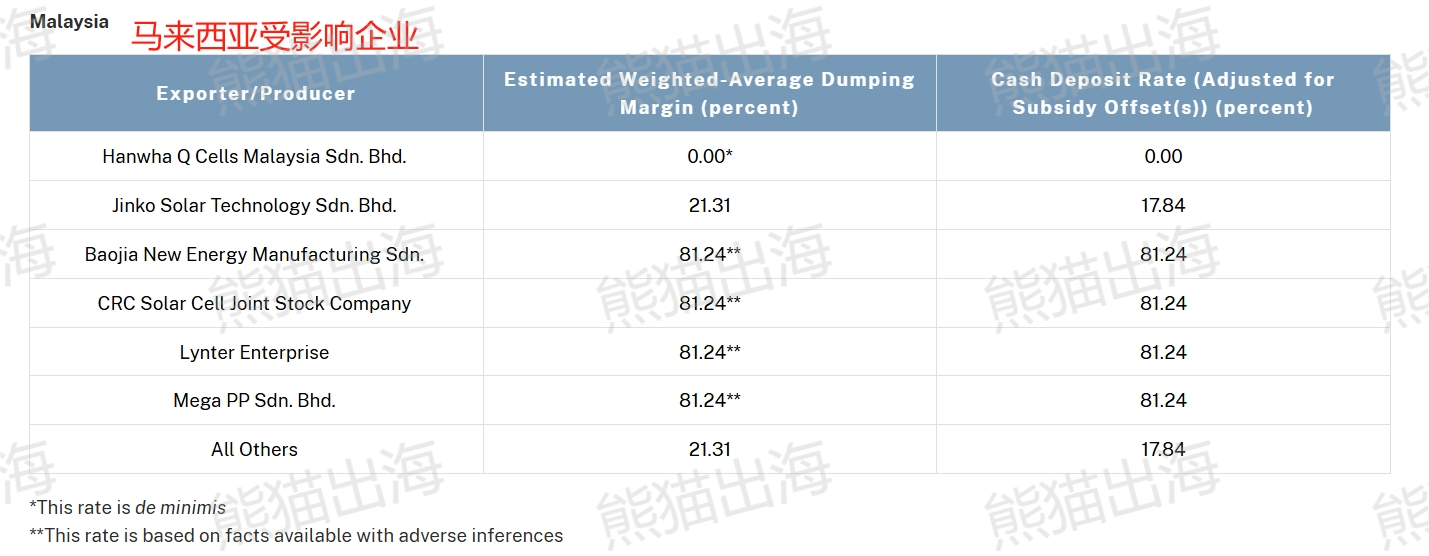

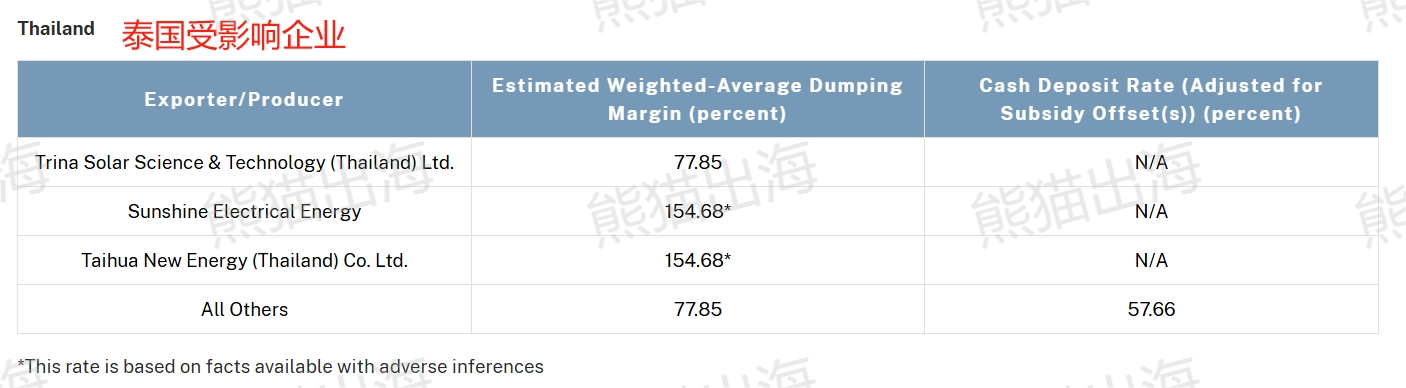

On November 29, local time, the U.S. Department of Commerce announced its preliminary affirmative ruling on the anti-dumping duty investigation on crystalline photovoltaic cells (whether assembled into modules or not) in four Southeast Asian countries, namely Cambodia, Malaysia, Thailand and Vietnam:

The anti-dumping duty rates of the four countries range from 0 to 271.28%.

But the final result will be announced in mid-2025.

Relevant data show that by the end of 2023, Southeast Asia has a total of 59.8GW of photovoltaic cell production capacity and 90.6GW of photovoltaic module production capacity, accounting for 9%-10% of the world. In addition to battery modules, supporting production capacity is developed. Inverter and auxiliary material companies such as Sungrow, Foster, Follett, and Flagship have set up factories here.

It is understood that the United States has imposed multiple rounds of trade barriers on imported photovoltaic products since 2012, mainly including:

1) "double reverse" investigations on China and Taiwan;

2) 201 tariffs;

3) 301 tariffs;

4) UFLPA Act;

5) Southeast Asia anti-circumvention investigations, etc.

Under five rounds of trade sanctions, domestic photovoltaic companies and supporting auxiliary materials circumvented tariff restrictions by transferring production capacity to Southeast Asia and entered the high-premium market in the United States.

After the "double reverse" is implemented, the advantages of the four countries in exporting to the United States may be greatly weakened or even have no ability to export to the United States.

At the same time, with the support of IRA subsidies, the production capacity of domestic photovoltaic modules in the United States has increased rapidly.

It is expected that the future US photovoltaic supply pattern will change from Southeast Asia integrated exports to the US to the form of "imported materials + local components".

For more Southeast Asian investment information, please consult PDAEXSEA professional consultants.