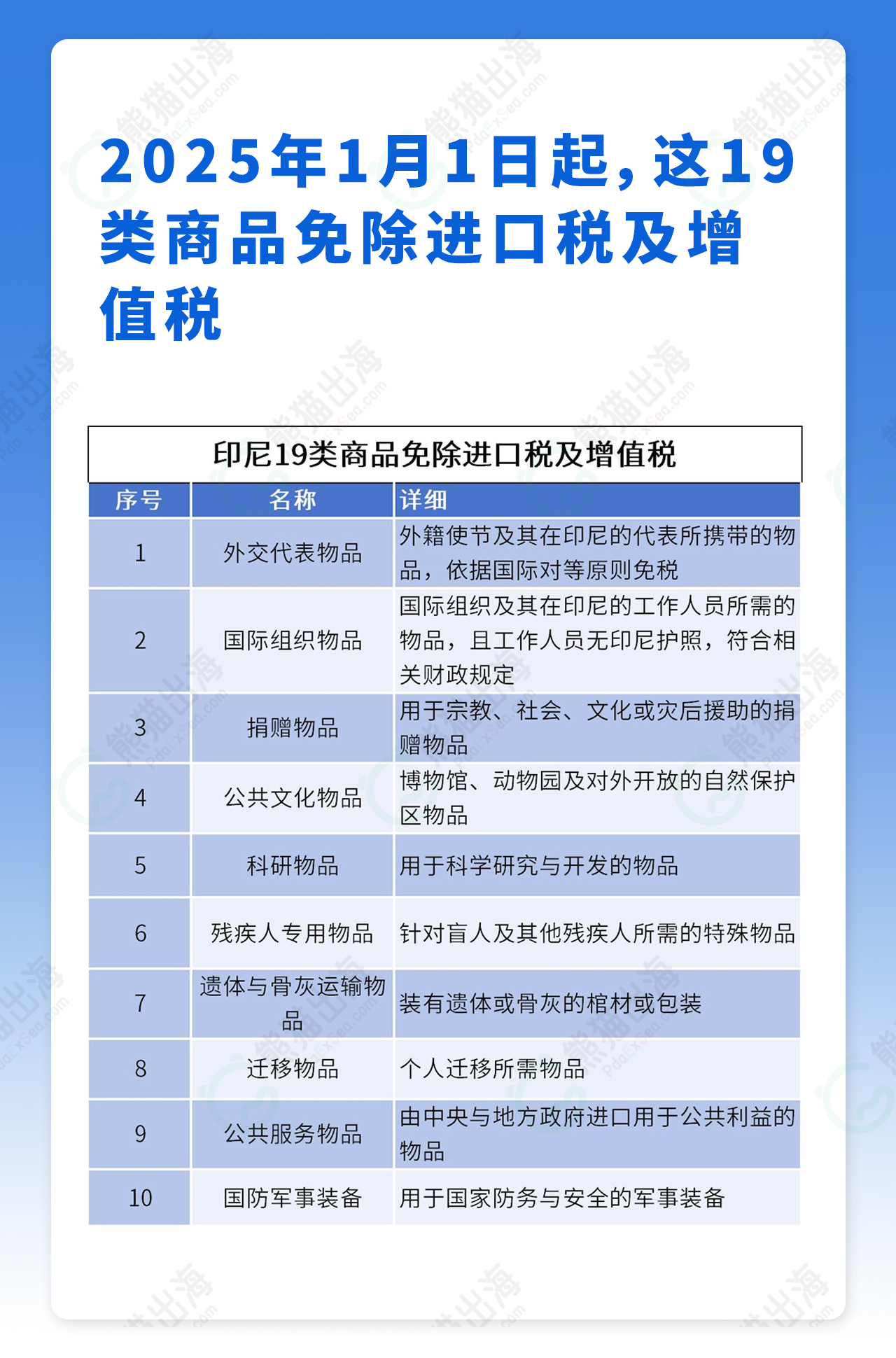

1. Starting from January 1, 2025, the following 19 categories of goods will be exempted from import duties and value-added tax:

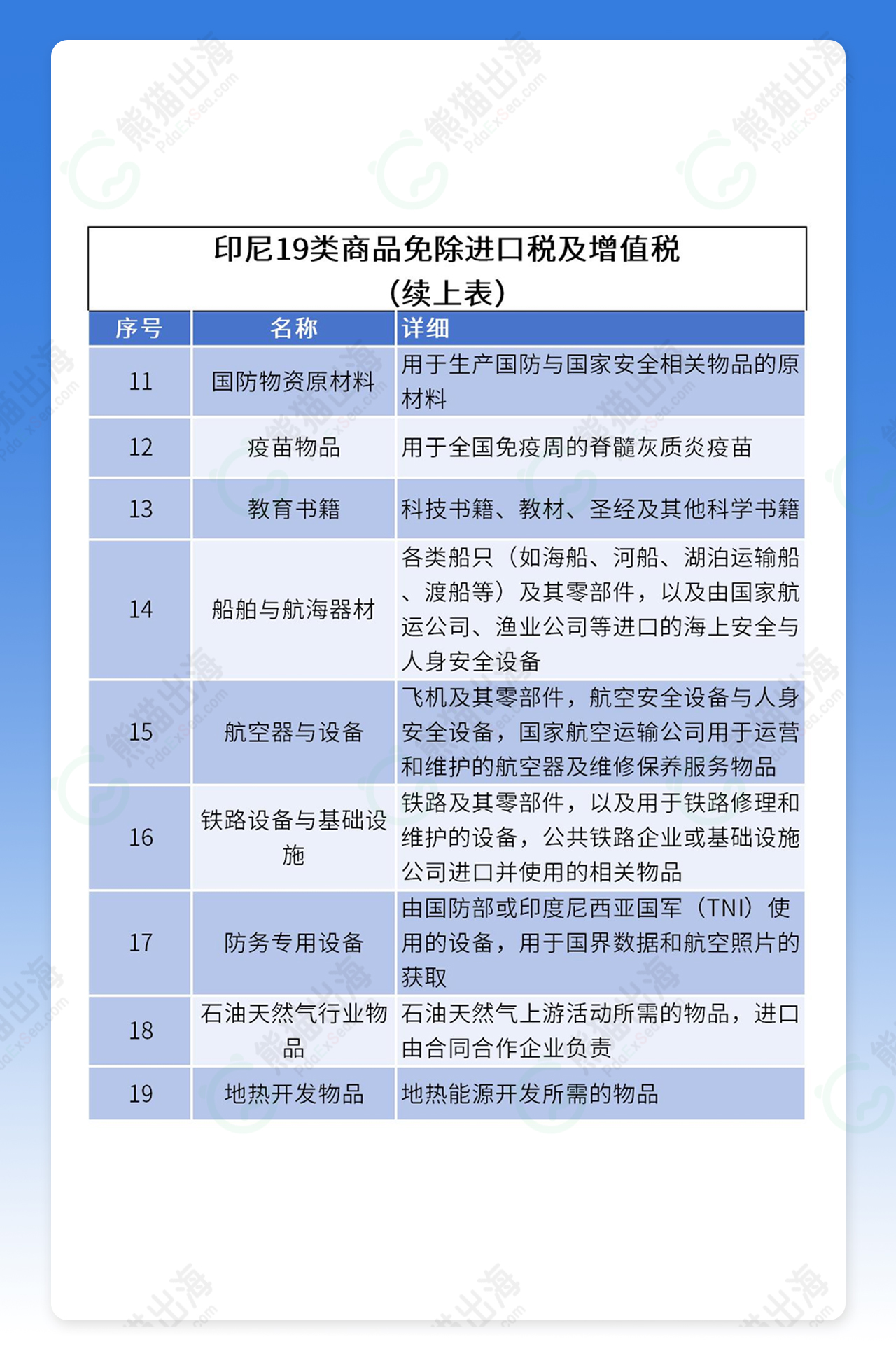

Such as diplomatic representative items, international organization items, donated items, public cultural items, scientific research items, items for the disabled, items for transporting bodies and ashes, migration items, public service items, national defense military equipment, defense materials and raw materials, vaccine items, educational books, ships and navigation equipment, aircraft and equipment, railway equipment and infrastructure, defense-specific equipment, oil and gas industry items, geothermal development items, etc.

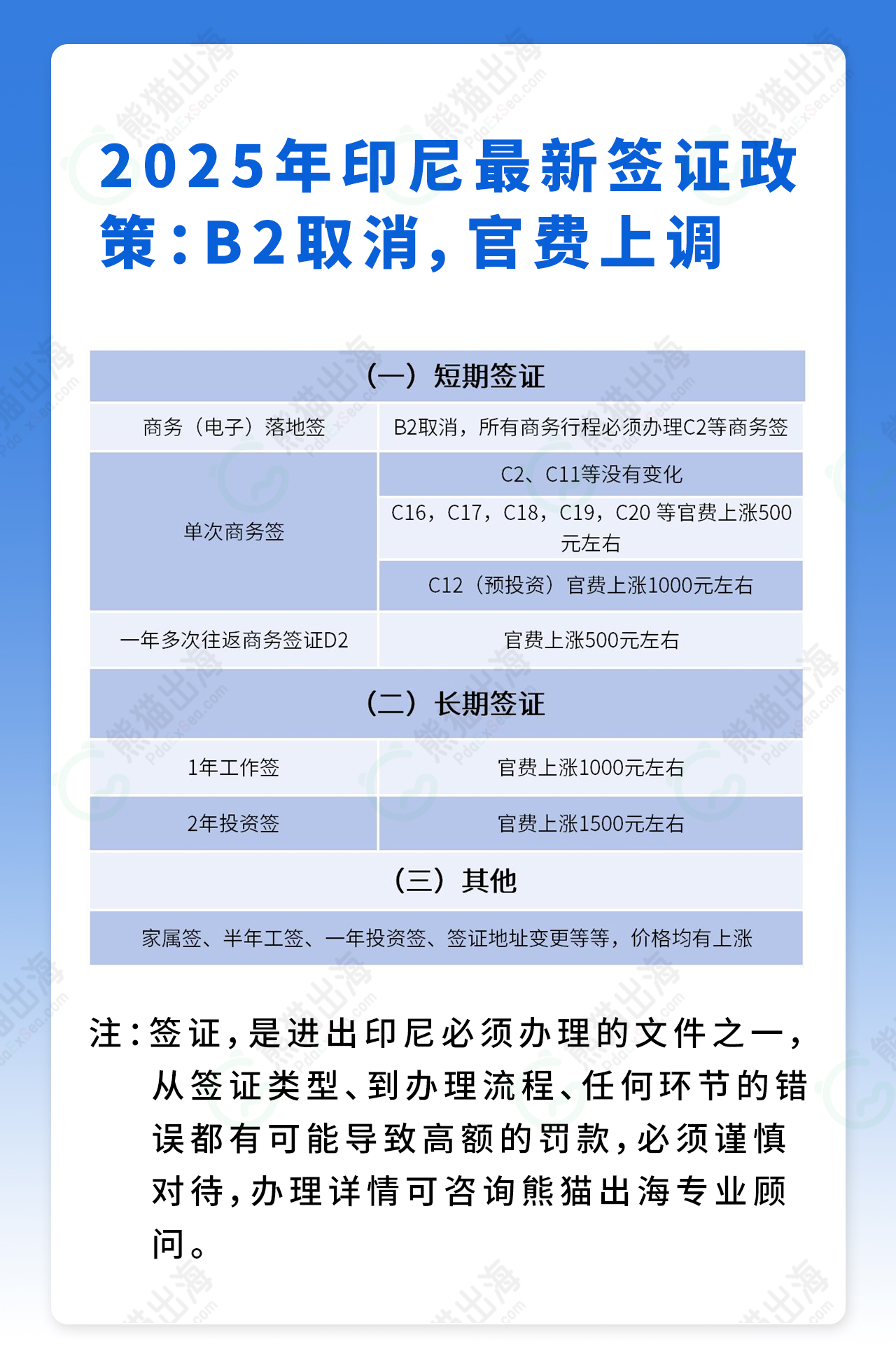

2. Indonesia's latest visa policy in 2025: B2 cancelled, official fees increased

(I) Short-term visa:

1. Business (electronic) visa on arrival B2 cancelled (the system has offline application channel), all business trips must apply for C2 and other business visas;

2. Single business visa:

C2, C11, etc. have not changed;

3. Single business visa:

C16, C17, C18, C19, C20, etc. official fees increased by about 500 yuan;

4. Single business visa:

C12 (pre-investment) official fees increased by about 1,000 yuan;

5. One-year multiple-entry business visa D2: official fees increased by about 500 yuan;

(II) Long-term visa:

1. 1-year work visa, official fees increased by about 1,000 yuan;

2. 2-year investment visa, official fees increased by about 1,500 yuan

(III) Others:

Family visa, half-year work visa, one-year investment visa, visa address change, etc., all have increased prices.

Note: Visa is one of the documents that must be obtained when entering and leaving Indonesia. From visa type to application process, any mistake in any link may result in a high fine, so you must be careful. For details, please consult PDAEXSEA professional consultants.

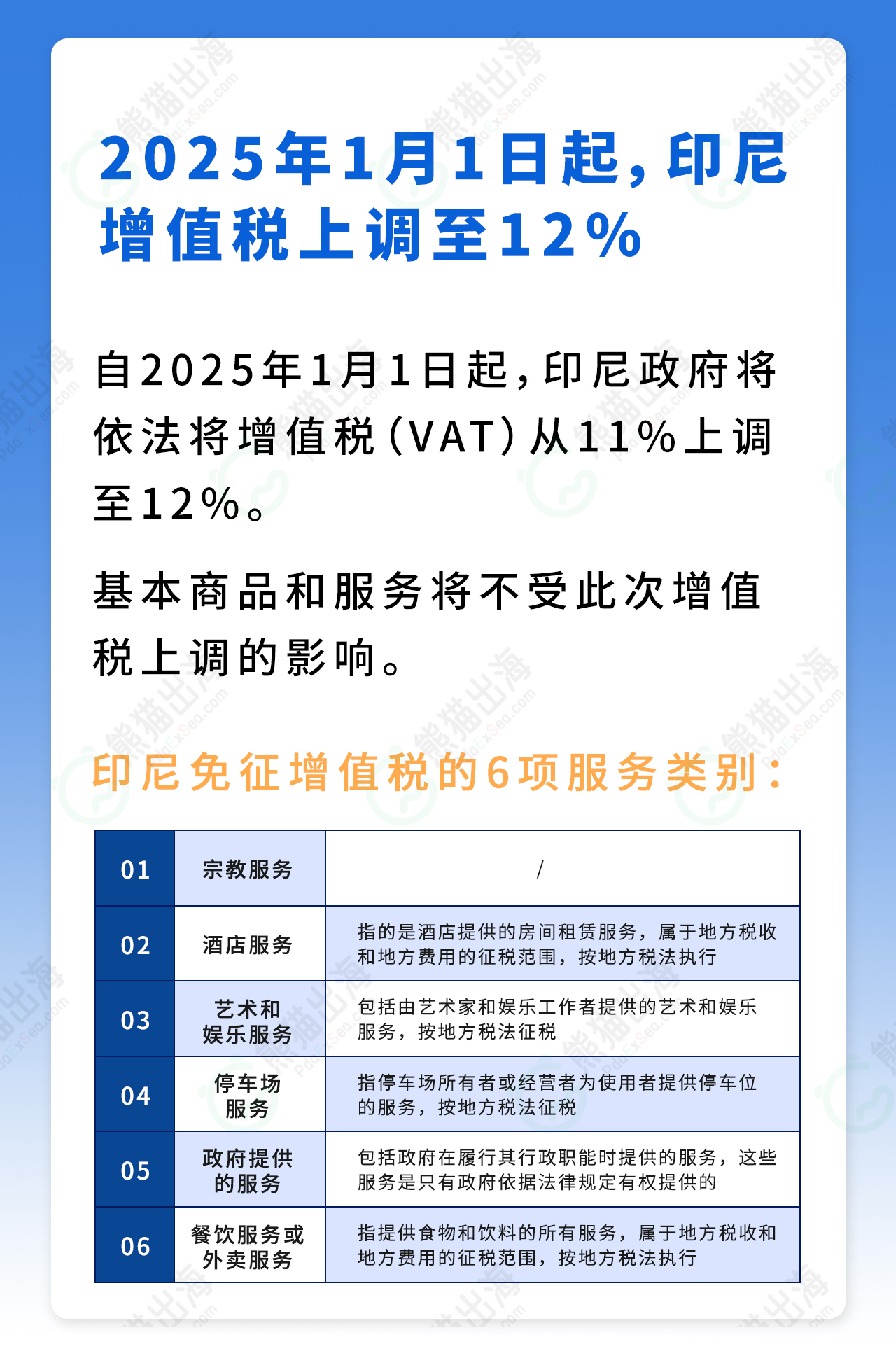

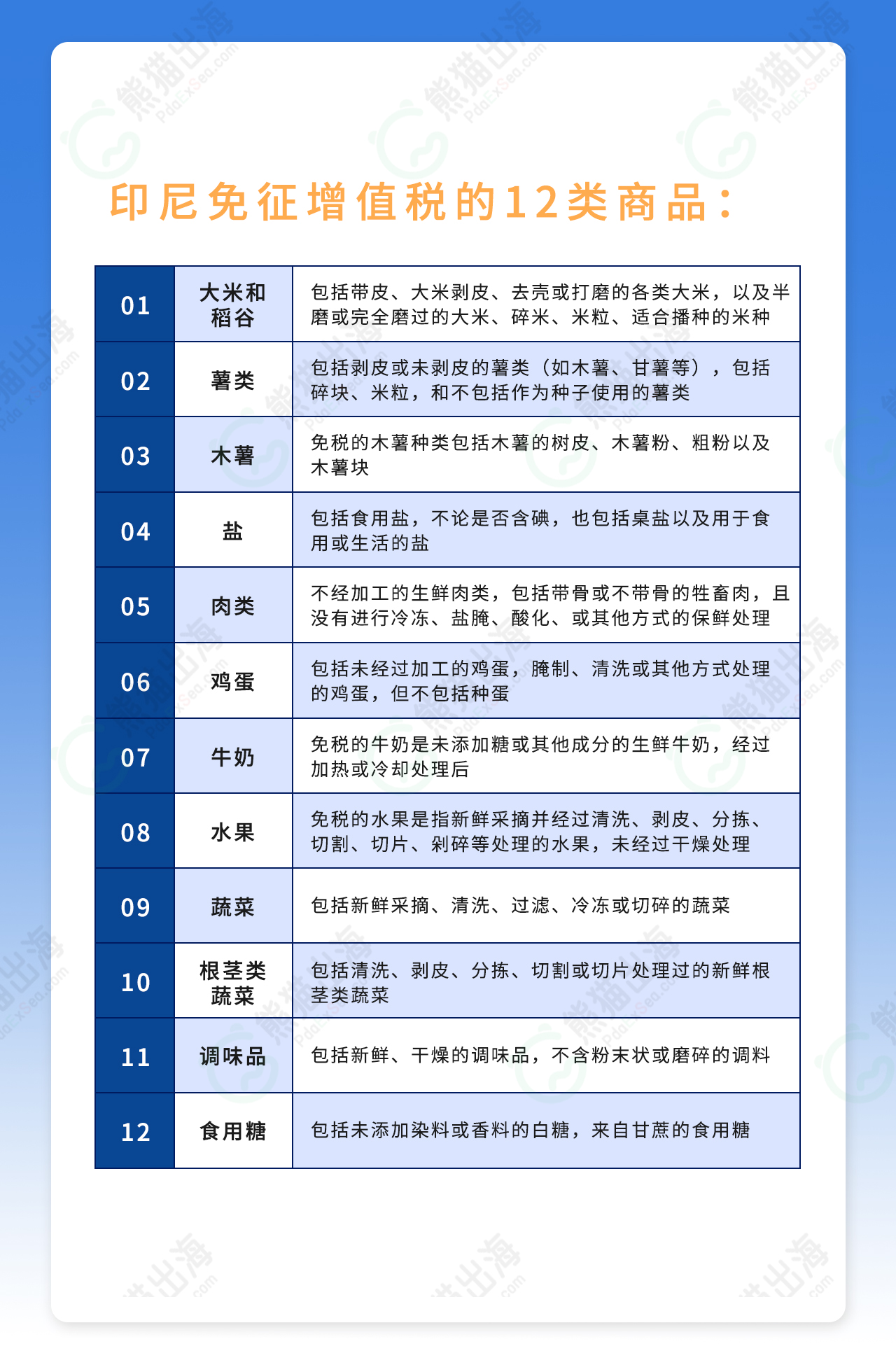

Starting from January 1, 2025, the Indonesian government will increase the value-added tax (VAT) from 11% to 12% in accordance with the law.

Basic goods and services will not be affected by this VAT increase.

See the article for details: Starting next year, Indonesia's VAT will be raised to 12%, ranking first in Southeast Asia. What impact will it have on companies?

4. Starting from January 1, 2025, Indonesia's minimum wage will increase by an average of 6.5%. Jakarta will still lead the way, at 5,396,761 rupiah, equivalent to RMB 2,453.

For more information on Southeast Asian investments, please consult PDAEXSEA professional consultants.