The Indonesian government announced that from January 1, 2025, the VAT rate will be increased from 11% to 12%, making it the first among the VAT rates in Southeast Asian countries:

0: Brunei

2.5%: East Timor has no VAT, but is taxed at a sales tax rate of 2.5%

5%: Myanmar has a 5% business tax rate

7%: Thailand has a statutory VAT rate of 10%, and the actual VAT rate adopted since April 1999 is 7%

8%: Vietnam (8% VAT rate for goods and services subject to a 10% tax rate until June 30, 2025), Singapore (8% goods and services tax)

10%: Cambodia, Laos, Malaysia

12%: Indonesia (from January 1, 2025), the Philippines

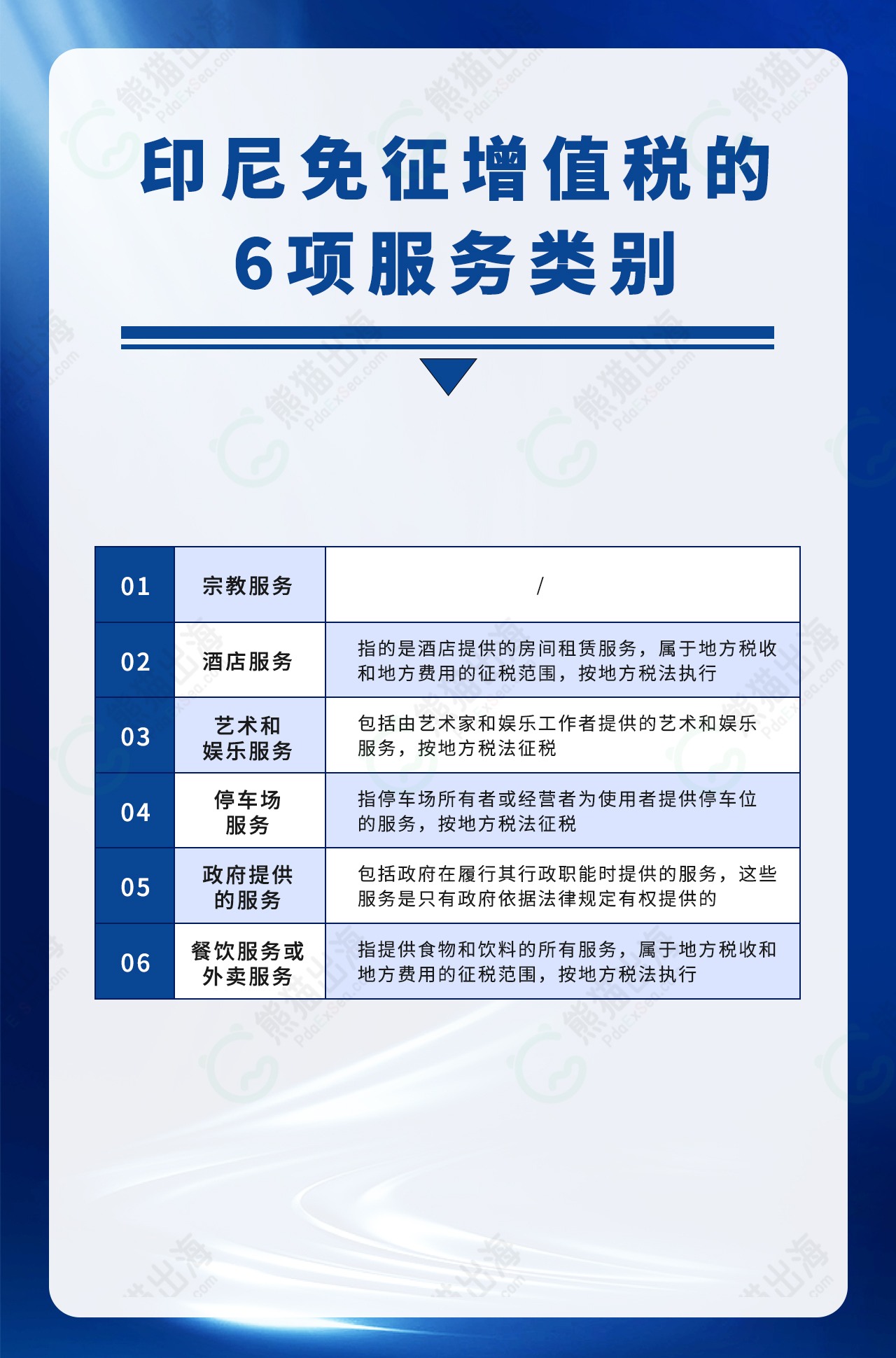

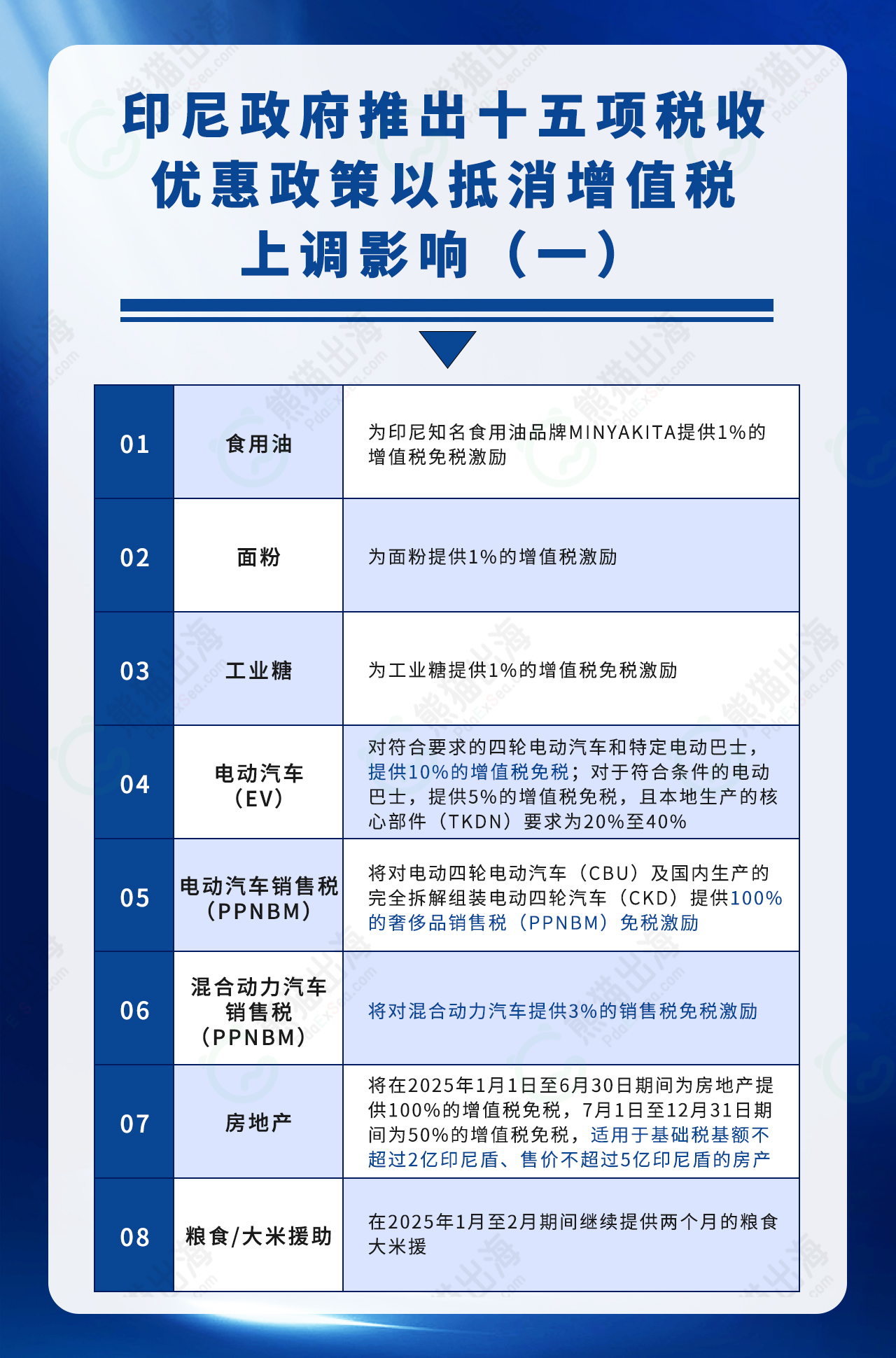

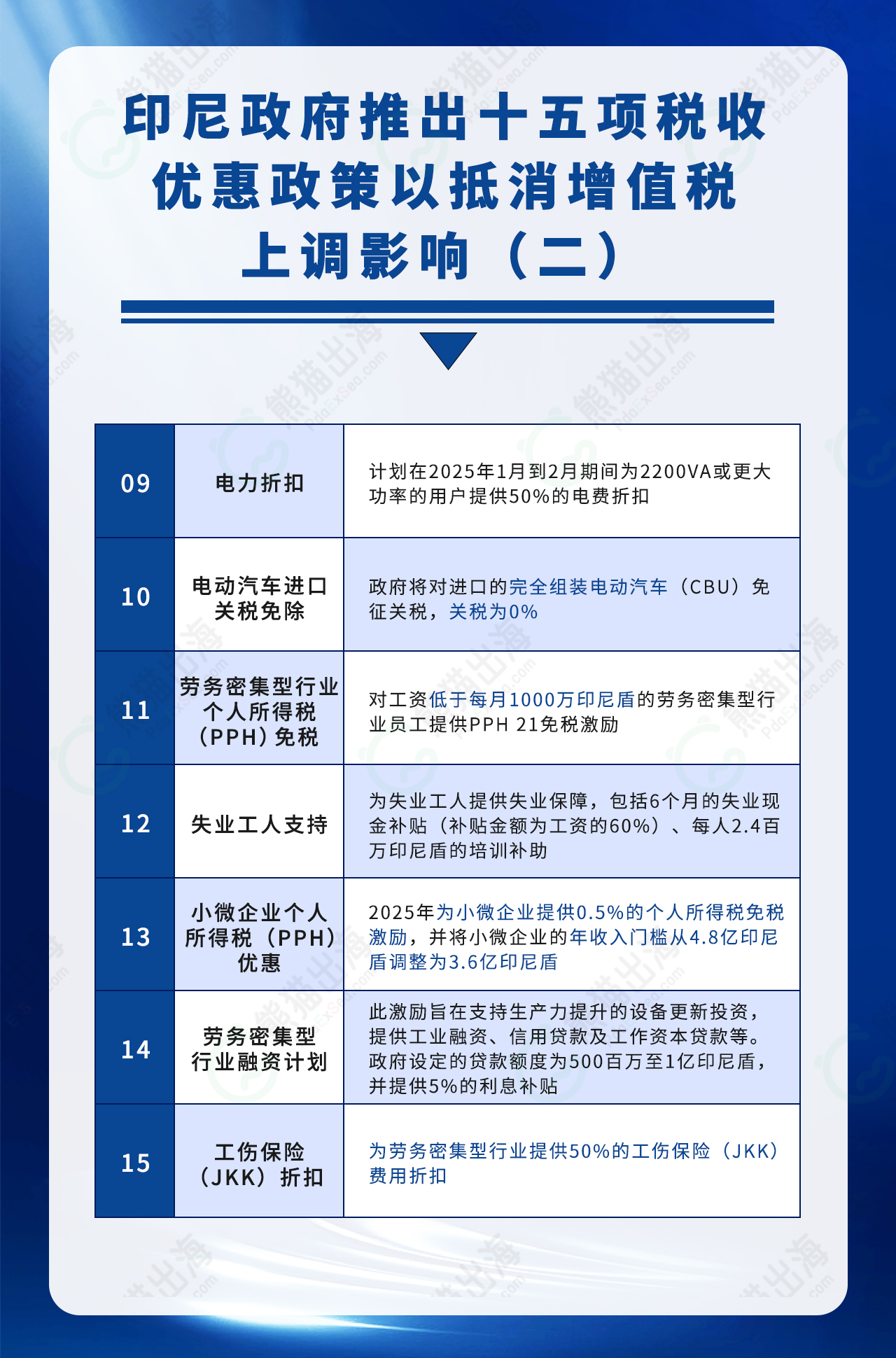

In order to mitigate the impact of tax rate increases on middle- and low-income groups, the Indonesian government has implemented a series of fiscal support measures, such as tax exemptions on daily necessities, electricity fee reductions and tax exemptions for labor-intensive industries.

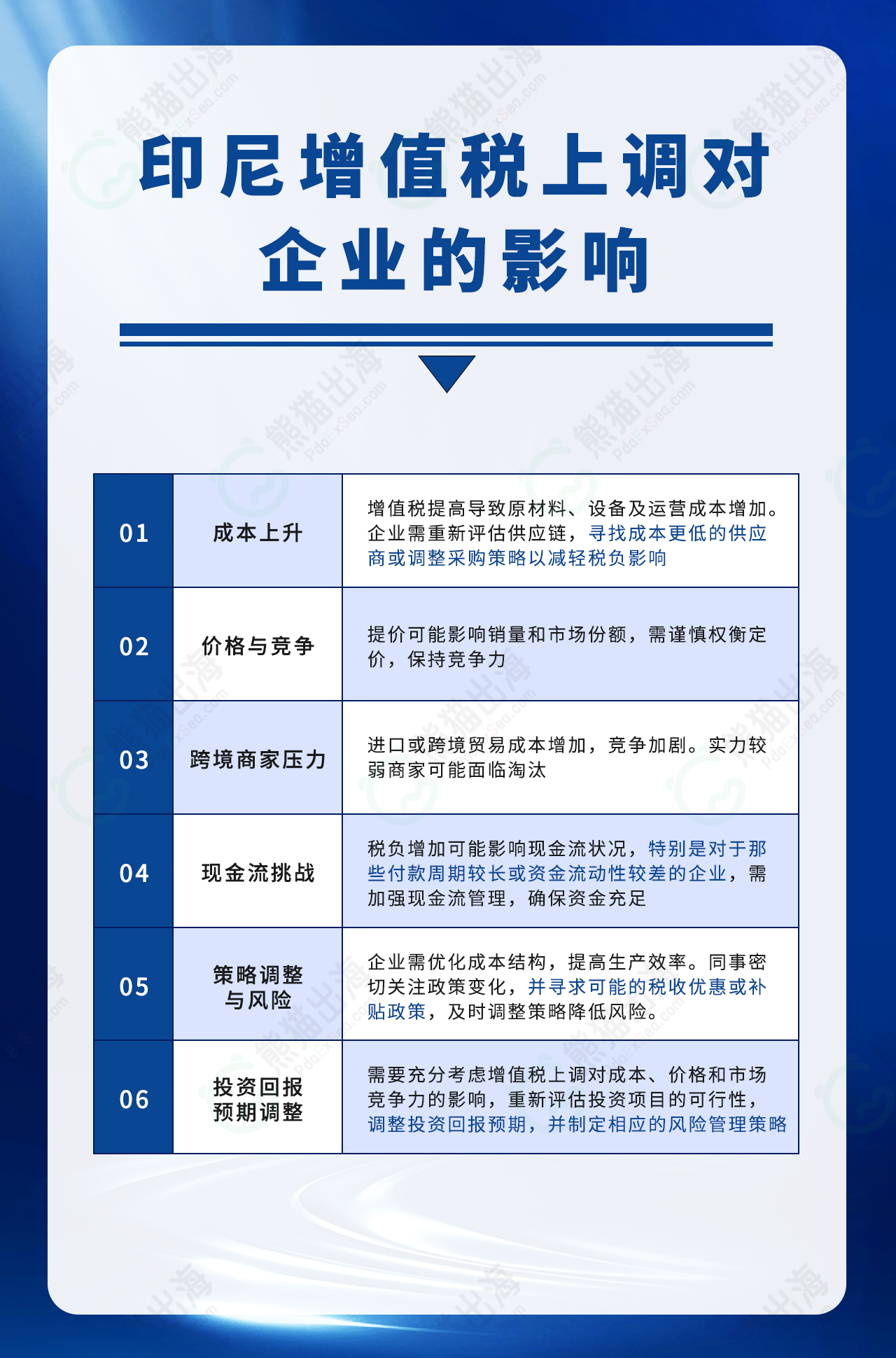

However, it will still have a certain impact on the operating environment of local enterprises:

Rising costs:

The increase in VAT leads to an increase in raw materials, equipment and operating costs. Enterprises need to re-evaluate the supply chain, find lower-cost suppliers or adjust procurement strategies to reduce the impact of tax burden.

Price and competition:

Price increases may affect sales and market share, and pricing needs to be carefully weighed to maintain competitiveness.

Pressure on cross-border merchants:

Import or cross-border trade costs have increased, and competition has intensified. Weaker merchants may face elimination.

Cash flow challenges:

Increased tax burdens may affect cash flow conditions, especially for those companies with long payment cycles or poor liquidity, which need to strengthen cash flow management to ensure sufficient funds.

Strategy adjustment and risk:

Enterprises need to optimize cost structure and improve production efficiency. At the same time, pay close attention to policy changes, seek possible tax incentives or subsidy policies (click on the picture for details and enlarge it to view), and adjust strategies in time to reduce risks.

Adjustment of investment return expectations:

It is necessary to fully consider the impact of VAT increases on costs, prices and market competitiveness, re-evaluate the feasibility of investment projects, adjust investment return expectations, and formulate corresponding risk management strategies.

For more information on Southeast Asian investments, please consult PDAEXSEA professional consultants.