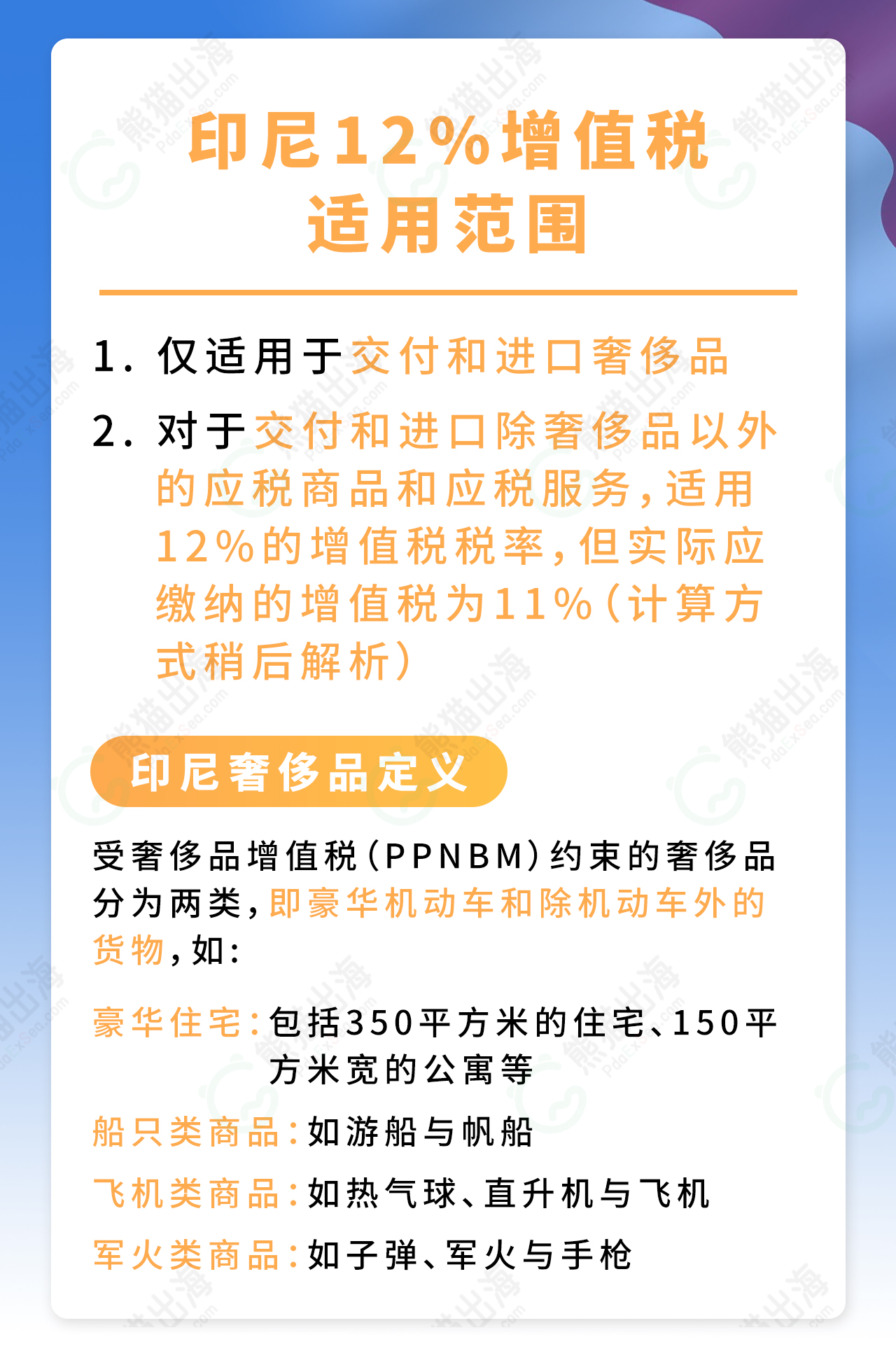

Only applies to the delivery and import of luxury goods;

For the delivery and import of taxable goods and taxable services other than luxury goods, a 12% VAT rate applies, but the actual VAT payable is 11% (the calculation method will be explained later)

Definition of luxury goods in Indonesia:

Luxury goods subject to the luxury goods VAT (PPnBM) are divided into two categories, namely luxury motor vehicles and goods other than motor vehicles, such as:

Luxury residences: including 350 square meters of residences, 150 square meters of apartments, etc.

Ship goods: such as cruise ships and sailboats

Aircraft goods: such as hot air balloons, helicopters and airplanes

Munitions goods: such as bullets, munitions and pistols

2. Calculation method of Indonesia's 12% VAT

Luxury goods

The taxation method for luxury motor vehicles and other luxury goods subject to PPnBM delivered to end customers (retail) or imported is as follows:

Transition period:

From January 1 to 31, 2025, the VAT is 12% of the alternative VAT base (i.e. 11/12 of the sales price or import price). The VAT payable is actually 11% of the sales price or import price.

Calculation formula: (sales price/import price × 11/12) × VAT rate 12%

After the transition period:

From February 1, 2025, the VAT will be 12% of the sales price or import price.

Calculation formula: sales price/import price X 12%

Luxury exports are still exempt from VAT, with a tax rate of 0%.

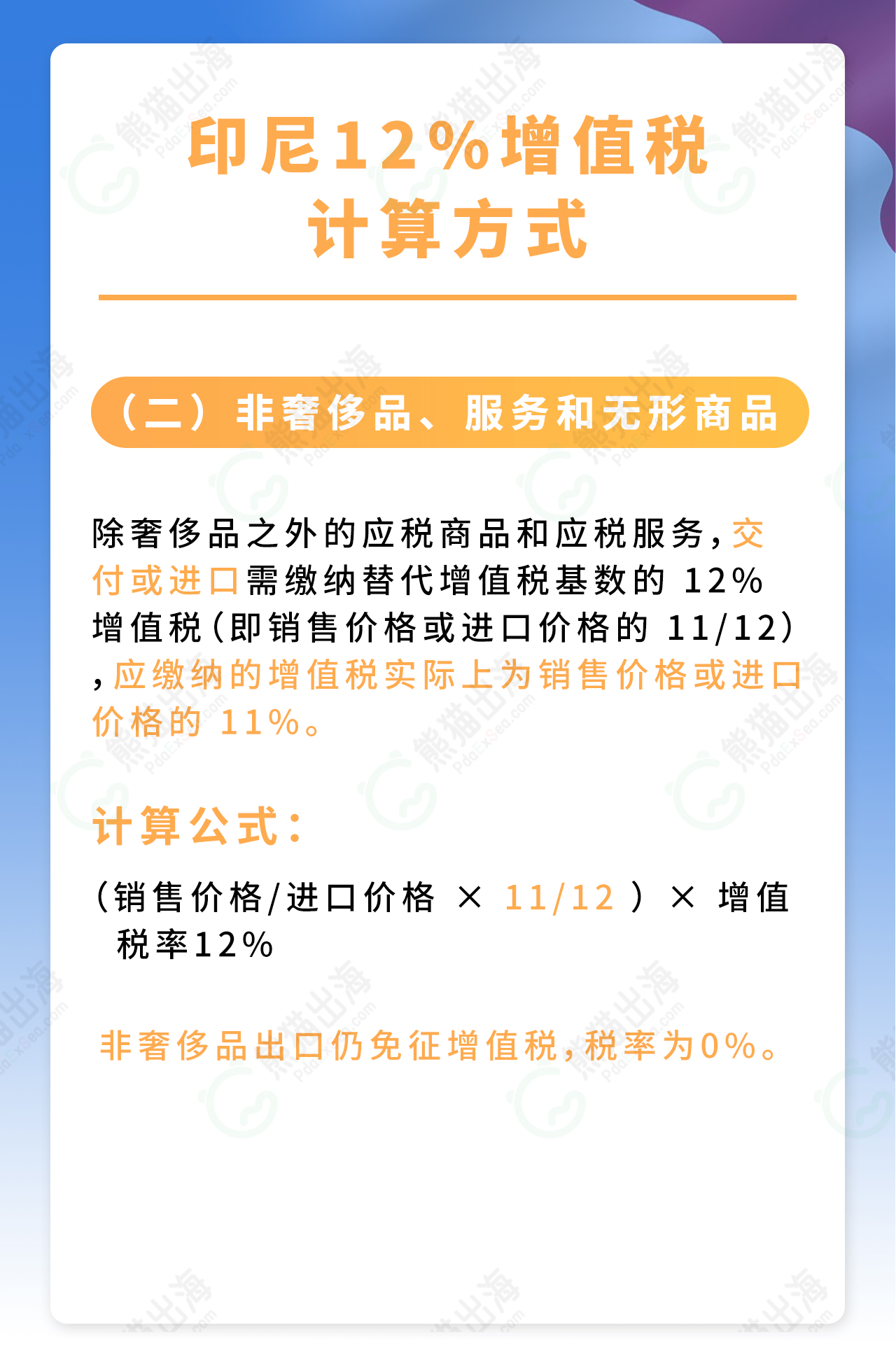

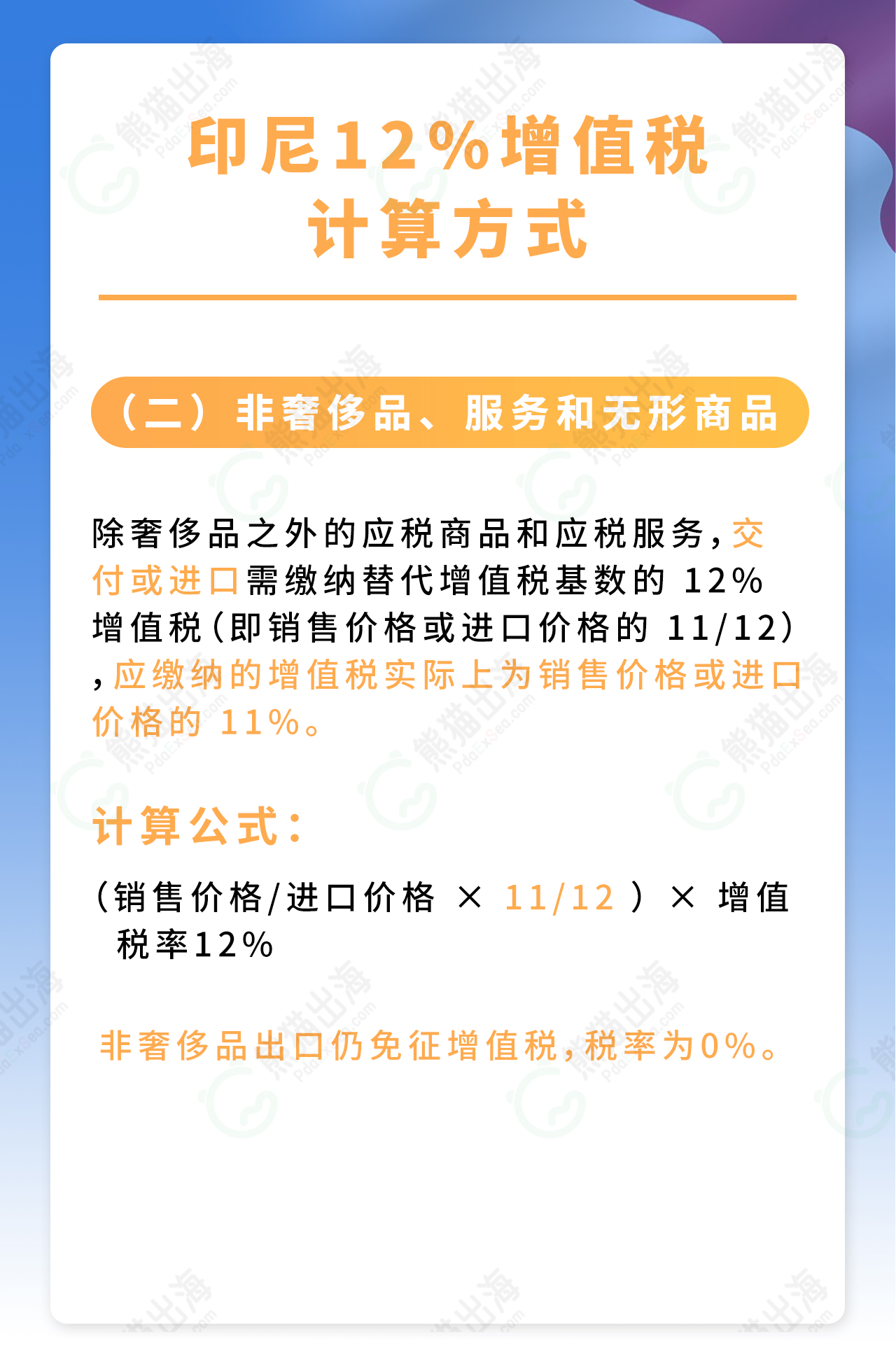

Non-luxury goods, services and intangible goods:

Except for luxury goods, taxable goods and taxable services are subject to a 12% VAT on the alternative VAT base (i.e. 11/12 of the sales price or import price) upon delivery or import, and the VAT payable is actually 11% of the sales price or import price.

Calculation formula: (sales price/import price × 11/12) × VAT rate 12%

Non-luxury exports are still exempt from VAT, with a tax rate of 0%.、

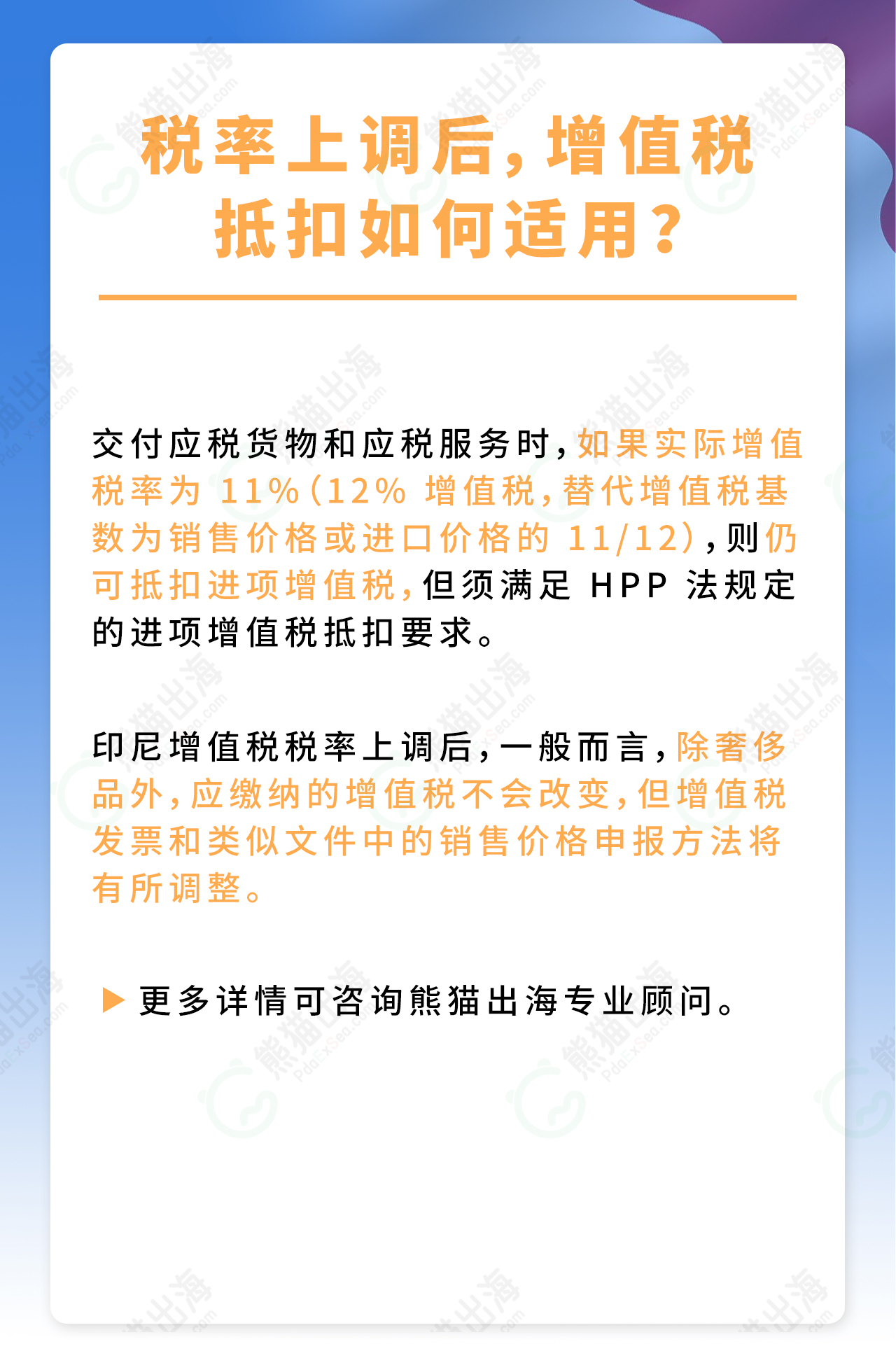

3. How does VAT deduction apply after the tax rate increase?

When delivering taxable goods and taxable services, if the actual VAT rate is 11% (12% VAT, the alternative VAT base is 11/12 of the sales price or import price), the input VAT can still be deducted, but the input VAT deduction requirements stipulated in the HPP Law must be met.

After the VAT rate increase in Indonesia, generally speaking, the VAT payable will not change, except for luxury goods, but the method of declaring the sales price in VAT invoices and similar documents will be adjusted.

For more details, please consult PDAEXSEA professional consultants.