Personal Income Tax Rates丨Indonesia Tax Guide 2025 (13)

tax guide

Tax Guide

Tax guide

Indonesia Investment

Indonesia investment

Personal Income Tax Practice

2025-01-23 09:32:59

Page view:1379

This issue's introduction

Tax rate

Chapter II Individual Income Tax

tax rate

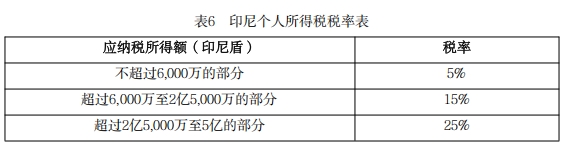

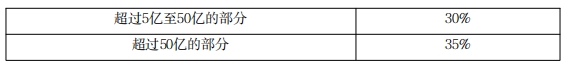

From January 1, 2022, the income of resident individuals will be taxed at the following rates:

① The income must come from business activities, not from employment or as a professional (such as lawyers, accountants, architects, actors, athletes, lecturers or speakers, writers, etc.);

② The total income (total income not subject to final tax) does not exceed 4.8 billion rupiah in a fiscal year. However, it does not include the following business activities of individual taxpayers:

A. Use of temporary facilities that can be permanently or non-permanently removed;

B. Use of public places for business or sales.

From January 1, 2022, individual taxpayers who meet the specific income requirements and are required to pay final income tax at the final income tax rate of 0.5% are allowed to adjust the threshold of their non-taxable income in a tax year to 500 million rupiah.

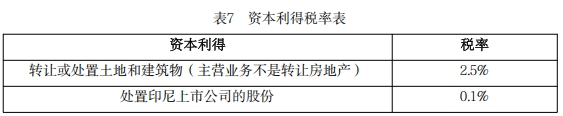

(2) Capital gains

Founders’ equity transactions (except for business partnerships owned by venture capital firms) are taxed at 0.1% if a final withholding tax of 0.5% of the transaction amount was paid at the time of the initial public offering of shares; otherwise, the normal tax rate applies.

(3) Withholding tax

Persons subject to withholding tax include employees, individuals receiving severance pay or pensions, non-employees who receive any income, board members, former employees and participants in activities.

Some taxpayers can apply for exemption from withholding tax by obtaining an exemption letter or a tax exemption letter. These taxpayers include:

First, taxpayers who can prove that they will not incur any tax payable due to loss compensation;

Second, taxpayers who can prove that the income tax withheld or to be withheld by them will exceed the amount of income tax payable;

Third, taxpayers who are subject to final tax on all their income.

① Employment income

Resident individuals are subject to deductible withholding tax on their employment income, which is subject to progressive tax rates ranging from 5% to 30% (see Table 6). If the taxpayer does not have a tax ID, an additional withholding tax rate of 20% will apply.

From July 1, 2024, Indonesian individual income tax residents will use their ID number as their tax ID; the tax ID number of foreign individuals will increase by one digit.

According to the announcement issued by the General Taxation Department on February 13, 2024, during the transition period when the ID number replaces the tax ID, taxpayers who use the ID number as their tax ID will not be subject to the additional withholding tax rate of 20%, nor will they be subject to the 100% withholding tax rate.

From January 1, 2024, the monthly withholding tax on salary income stipulated in Article 21 of the Income Tax Law will be calculated at the effective tax rate from January to November, and the annual tax amount will be calculated at the current progressive income tax rate in December.

The effective tax rate applies to the total income of the individual taxpayer for the month, without any annualization or deduction of the total income. The monthly effective tax rate is determined based on the taxpayer's monthly income, marital status and number of dependents.

For withholding tax purposes, income includes wages, allowances and all other regular remuneration, including overtime pay, bonuses and holiday allowances, but does not include accident and death insurance benefits, benefits in kind, income tax borne by the employer (unless borne by the representative office) or charitable collections.

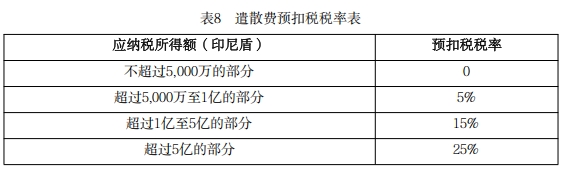

Effective November 16, 2009, severance pay paid in lump sum or in installments over 2 years is subject to final withholding tax at the following rates:

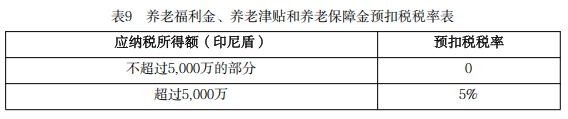

From November 16, 2009, pensions, allowances and pensions paid in lump sum or in installments within 2 years are subject to final withholding tax at the following rates:

If the employee's pension benefits are from an approved pension fund and are used to purchase a life annuity from a life insurance company, the employee will be deemed to have received the rights to pension benefits. Workers and non-permanent employees with a daily wage of less than IDR 450,000 are not subject to withholding tax, but if their total monthly income exceeds IDR 4.5 million or is received on a monthly basis, they are not tax-exempt.

② Dividends

From November 2, 2020, dividends received by resident individuals are tax-exempt, provided that the dividends will be reinvested in eligible investment projects in Indonesia and meet the relevant time requirements. The difference between the amount received and the amount reinvested will be subject to a final withholding tax of 10%. Resident individuals should pay the tax by the 15th of the month following the month in which the dividends are received.

MoF Regulation 18/PMK.03/2021 sets out a list of eligible investment projects and requires a minimum investment holding period of 3 years, and annual investment reports must be made by the end of March of the following year.

③ Interest

Resident individuals should generally pay a deductible withholding tax of 20% of the total interest received. If the taxpayer does not have a tax number, the withholding tax will increase by 100%.

The following situations are subject to a full 20% final withholding tax:

A. Interest income from the Indonesian Central Bank bond discount obtained from Bank Indonesia and Indonesian branches of overseas banks;

B. Interest income from time deposits, savings and resident personal savings deposits. However, individuals whose income is below the income tax threshold can request a tax refund.

From December 28, 2015, a lower tax rate applies to interest income from time deposits, savings or Indonesian central bank bond discounts that are funded by export earnings and deposited in Indonesian banks (including Indonesian branches of overseas banks):

The withholding tax rate for eligible US dollar deposits is 10% (deposit term 1 month) to 0% (deposit term 6 months or more); the withholding tax rate for eligible rupiah deposits is 7.5% (deposit term 1 month) to 0% (deposit term 6 months or more).

From August 30, 2021, bond interest is subject to a final withholding tax of 10%.

④Royalties

Residents' royalty income is subject to a 15% deductible withholding tax on the full amount. If the taxpayer does not have a tax number, the withholding tax will increase by 100%.

⑤ Other income

Residents or non-residents who sell the following assets (valued at more than 10 million rupiah) are subject to an effective final withholding tax rate of 5% calculated on the sales price, subject to the provisions of the applicable tax treaty (arrangement): A. Large decorative items; B. Jewelry, including gold, luxury watches and gemstones such as diamonds; C. Antiques and paintings; D. Vehicles, such as cars, motorcycles, cruise ships and light aircraft.

Other types of income received by resident individuals are subject to withholding tax, as follows:

The excitement continues in the next issue...