This issue's introduction

Tax benefits

Chapter II Individual Income Tax

(1) Tax exemption

① New Year allowances, production bonuses, tips, labor fees or other forms of income received by employees or workers can be deducted from their income as personal tax exemptions.

The income obtained by a married woman from production business or professional work should be combined with the income of her husband, and the tax burden should be determined based on the total income of the husband and wife.

The income that a married woman receives from others who are not related to the business of her husband or family members and is subject to withholding tax is considered her personal income. Married women can also choose to have all their income assessed in their personal name.

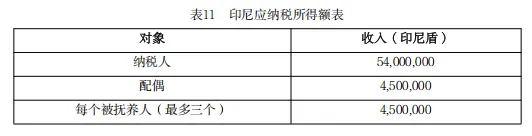

From January 1, 2016, the following non-taxable income can be deducted from net income to determine taxable income:

③ Grants, aid or donations received by families or individuals operating small and micro enterprises are tax-free. Small and micro enterprises refer to enterprises with a net asset value of no more than 500 million rupiah (excluding the value of land and buildings used as business premises) or an annual turnover of no more than 2.5 billion rupiah.

This tax exemption policy applies if there is no business or working relationship between the grantor or donor and the receiving enterprise, and no ownership or control over it.

④ From January 1, 2009, scholarships received by Indonesian citizens to pay for tuition, examination fees, research fees, book fees and reasonable living expenses required for basic, secondary, high school and higher education in Indonesia or abroad are tax-free. This tax exemption policy applies if the scholarship recipient has no special relationship with the owner, commissioner, supervisor and management department of the scholarship.

⑤ Grants paid by designated social security institutions to people or groups living below the national poverty line or affected by natural disasters or difficulties are tax-free. Social security institutions refer to statutory institutions established to manage and operate social security programs.

"Natural disasters" include earthquakes, tsunamis, volcanic eruptions, floods, droughts, typhoons and landslides, while "difficulties" refer to accidents that endanger or threaten life safety.

⑥ Foreign employees who are determined to be domestic taxpayers due to their Indonesian resident status can only pay income tax on their income from Indonesia (including overseas payments), but they must meet certain conditions, such as meeting relevant professional skills requirements, and this clause is only applicable in the first four tax years after being identified as Indonesian resident individuals.

If foreign employees have enjoyed the benefits of the tax agreement (arrangement) between Indonesia and the country of origin of the income, they cannot further apply the exemption clause for taxation from the geographical source.

⑦ Payments made by insurance companies for accident, illness, death or scholarship insurance.

⑧ Distribution of retained income of cooperatives.

(2) Deductions

Withholding taxes paid by resident individuals can be used to offset final income tax, and the excess amount can be refunded. Departure tax can also be deducted.

Taxes paid by resident individuals on income from foreign sources abroad, whether unilaterally or under a tax treaty (arrangement), can be used for general tax credits. The credit limit is limited to the following minimum values:

① Taxes paid abroad;

② The amount obtained by multiplying the tax payable on global taxable income calculated in accordance with Indonesian tax law by the proportion of foreign income;

③ The income tax payable in Indonesia.

Foreign losses are not taken into account when calculating the credit.

The above calculation method is only applicable to direct credits and is country-by-country, that is, the credit enjoyed for taxes paid in one country can only be used to offset the tax payable calculated in accordance with Indonesian tax law on income from the same country. Foreign taxes that exceed the credit limit cannot be refunded.

(3) Losses

① General losses

Net losses are the amount by which deductibles exceed total income. Generally speaking, net losses include operating losses and capital losses, unless the latter are expressly prohibited from being deducted. Losses can be carried forward for 5 years without restriction and offset against profits in subsequent years. For certain industries specified by the Ministry of Finance, losses can be carried forward for 10 years.

If a woman gets married at the beginning of the calendar year, her losses incurred in previous years from running a business or engaging in professional work are considered her husband's losses and can continue to be carried forward unless she chooses to be assessed separately.

② Asset losses

Losses incurred from the sale or transfer of property or interests in order to obtain income from running a business can be deducted. Capital losses incurred from the disposal of equity can also be deducted.

Ministry of Finance Regulation No. 27 of 2023 (PMK-72) stipulates that if the transfer or exit of an asset is paid for by insurance money, the remaining book value of the asset will be recorded as a loss, while the selling price and insurance compensation amount will be recorded as income in the year of the asset exit.

If the insurance compensation can only be determined in a future period, the loss will be recorded in the year in which the insurance compensation is received, but this requires prior approval from the Tax Bureau.

The excitement continues in the next issue...