VAT Rates丨Indonesia Tax Guide 2025 (19)

Indonesia

VAT

2025-02-10 08:38:29

Page view:1104

This issue's introduction

tax rate

Chapter III Value Added Tax

Tax Rate

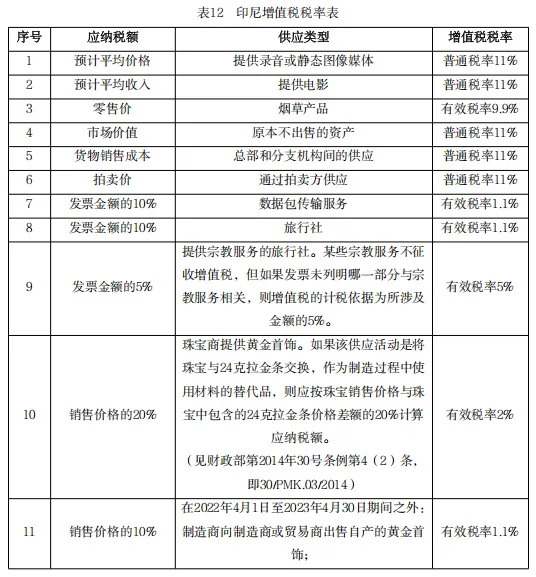

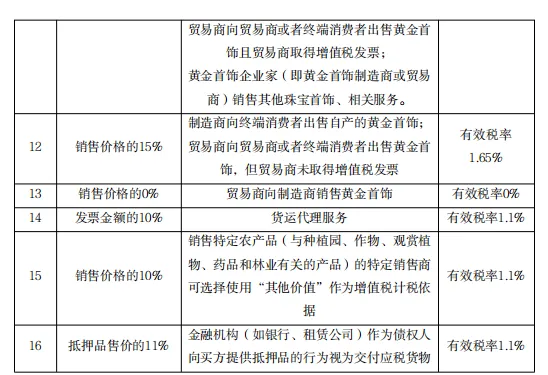

Decree No. 7 of 2021 provides for the implementation of the final VAT system for certain goods and services from April 1, 2022. Under the final VAT rate system, the current VAT rate is multiplied by a specified percentage to obtain the effective final VAT rate.

Unless otherwise specified, the general tax base is the retail sales price. Input tax under the final VAT system is not deductible. Indonesia's export of taxable goods is subject to a 0% VAT rate, including:

(1) VAT taxpayers exporting taxable tangible goods;

(2) VAT taxpayers exporting taxable intangible goods;

(3) VAT taxpayers exporting taxable services.

The VAT on the export of taxable tangible goods is regulated by the customs, and the exporter must issue an export declaration.

The export of intangible goods or services is regulated by the tax bureau. Exporters must submit an export declaration form to the Indonesian Taxation Bureau, listing the transaction items. Exported intangible goods include:

(1) Use or right to use copyright, patent, design or model, plan, formula or secret recipe, trademark, intellectual/industrial property or other equivalent rights of literary, artistic or scientific works;

(2) Use or right to use equipment or industrial, commercial or scientific tools;

(3) Provide know-how or information in the field of science, engineering, industry or commerce;

(4) Provide additional or supplementary support for the use and right to use described in [1], the use and right to use equipment and tools described in [2], or the know-how or information described in [3] in the following forms:

① Receiving or having the right to receive images or recordings transmitted by satellite, cable, optical fiber or equivalent technology;

② Receiving or having the right to receive images or recordings or both of television programs broadcast by satellite, cable, optical fiber or equivalent technology;

③ Use or having the right to use part or all of the radio spectrum for communications.

(5) Use or right to use film or videotapes of television programs, or audiotapes of radio programs;

Complete or partial renunciation of the use or right to use the above intellectual, industrial or other rights.

According to the Value Added Tax Law No. 42 of 2009, which came into effect on April 1, 2010, the VAT rate applicable to the export of services is zero. However, the Ministry of Finance's regulations further stipulate that the zero-rate VAT only applies to the following services:

(1) Contractual subcontracting services that meet the following conditions:

① The buyer or recipient of the taxable services is a non-resident taxpayer abroad and is not a permanent establishment specified in the Income Tax Law;

② Specifications and materials are provided by the buyer or recipient of the taxable services;

③ Ownership of the taxable goods belongs to the buyer or recipient;

④ The subcontractor delivers the products abroad at the request of the buyer or recipient of the taxable services.

(2) Construction services provided abroad, including construction planning, construction engineering and construction supervision;

(3) Repair and maintenance services related to current assets used abroad.

Sales related to gold jewelry are defined as:

(1) Delivery of gold jewelry produced by the manufacturer to the gold jewelry enterprise that orders the gold jewelry and provides the specifications, raw materials, semi-finished products or auxiliary materials (all or part);

(2) Gold jewelry enterprises provide raw materials in the form of gold jewelry and gold bars to manufacturers for the production of gold jewelry;

(3) Gold jewelry enterprises provide other jewelry as raw materials to manufacturers for the production of gold jewelry.

According to Government Regulation No. 44 of 2022 (GR44/2022):

(1) The final VAT charged to the buyer can be deducted by the buyer as input tax;

(2) If the strategic goods or services delivered by the VAT-taxable enterprise are subject to the final VAT system, but at the same time, the strategic goods or service facilities are subject to VAT exemption or non-taxation policy, the input tax cannot be deducted;

(3) Under the final VAT system, the tax base of the VAT-taxable enterprise for internal delivery, self-use and gifts is zero.

In addition, Indonesia's VAT regulations recognize the so-called "non-collected VAT", which applies to certain domestic transactions. This benefit is similar to the zero-rated system, with the output tax being zero and the input tax being deductible. The VAT exemption applies to:

(1) the sale of taxable goods or services to government projects funded by foreign loans or grants;

(2) the sale of taxable goods or services to bonded areas;

(3) the sale of taxable goods or services to enterprises in comprehensive economic development areas. KAPET areas are designated by presidential decree, and there are currently twelve KAPET areas in Indonesia;

(4) the sale of aviation fuel to international flights;

(5) the sale, purchase of goods or trading of goods in free trade zones and free port areas.

For insurance institutions, the VAT rate for insurance agency services is 1.1%, and the VAT rate for insurance brokerage services is 2.2%.

For financial institutions delivering collateral assets, the actual tax rate is 10% × VAT rate × tax base or 1.1% of the collateral sales price.

The next issue will continue...