VAT Tax Incentives丨Indonesia Tax Guide 2025 (20)

Indonesia

VAT

Tax incentives

2025-02-11 09:18:37

Page view:1017

This issue's introduction

Tax Benefits

Chapter III Value Added Tax

Tax Benefits

From April 1, 2022, the following goods or services are subject to VAT exemption.

① Food and beverages provided in hotels, restaurants and other places where regional taxes are already levied;

② Currency, gold bars and commercial bills used for national foreign exchange reserves;

③ Religious services;

④ Services provided by the government during government administration, including government public services that can only be provided by the government; hotels, parking lots, catering, art and entertainment services (services that have already levied regional taxes).

(2) From April 1, 2022, other goods or services that were previously subject to VAT exemption are no longer tax-free, and some of them may be subject to zero tax rate, including mining and drilling products directly obtained from the source, public daily necessities, medical services, financial services and education services.

(3) Tax exemption policy for real estate sales

According to the Ministry of Finance Regulation No. 60 of 2023, which came into effect on June 1, 2023, sales of public housing, student dormitories, housing for low-income workers and domestic workers can submit applications for VAT exemption through the tax bureau's electronic system. The standards for tax-free public housing and worker housing are:

① The building area is 21 to 36 square meters;

② The land area is 60 to 200 square meters;

③ The first self-owned housing for low-income individuals, used for living and will not be transferred within 4 years;

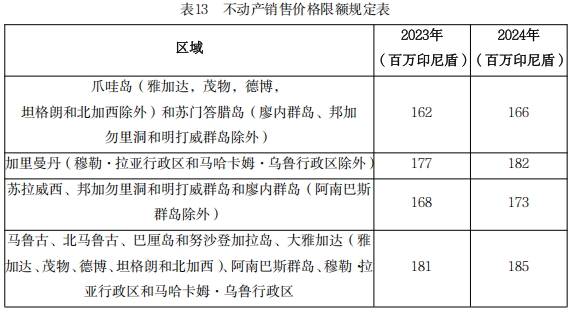

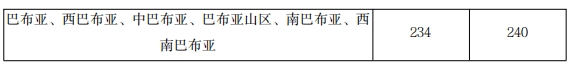

④ The sales price does not exceed the prescribed upper limit, the limit is as follows:

① Fulfill tax obligations and have no tax arrears;

② Meet the low-income threshold, which is determined by their average monthly income or in accordance with the regulations of the Ministry of Public Works and Housing;

③ Take a family as the tax unit and enjoy tax exemption for one house.

According to the Ministry of Finance Regulation No. 120 of 2023 and the Ministry of Finance Regulation No. 7 of 2024, eligible sales of houses and apartments from November 1, 2023 to December 31, 2024 can enjoy VAT benefits:

① From November 1, 2023 to June 30, 2024, when the sales amount does not exceed 5 billion rupiah, the government will bear 100% of the VAT, but not more than 2 billion rupiah;

② From July 1, 2024 to December 31, 2024, when the sales amount does not exceed 5 billion rupiah, the government will bear 50% of the VAT, but not more than 2 billion rupiah.

(4) The import and delivery of certain transport equipment, as well as the delivery and use services related to certain transport equipment, are "VAT-exempt items". If the transport service of taxable goods or services is a VAT-exempt item, the input tax paid for obtaining the taxable goods or services is deductible.

(5) According to Regulation No. 38 of the Ministry of Finance, which came into effect on April 1, 2023, battery-powered four-wheeled electric vehicles and buses sold between April 2023 and December 2023 are eligible for the following VAT benefits:

① For the delivery of battery-powered four-wheeled electric vehicles and buses with at least 40% of locally manufactured parts, the VAT is 1% (the remaining 10% of the VAT will be borne by the government);

② For the delivery of battery-powered electric buses with 20% to 40% of locally manufactured parts, the VAT is 6% (the remaining 5% of the VAT will be borne by the government).

The list of electric vehicles eligible for this benefit is published by the Ministry of Industry, but it only applies to newly registered vehicles.

According to the Ministry of Finance's Regulations No. 8 and No. 9 of 2024 (effective from February 15, 2024), the above preferential policies have been extended to December 2024.

(6) According to the Ministry of Finance's Regulation No. 141 of 2023, from December 10, 2023, Indonesian migrant workers can enjoy the following tax benefits:

① Indonesian migrant workers' qualified consigned goods and luggage are exempt from import value-added tax;

② For mobile phones, PDAs and tablets belonging to Indonesian migrant workers, they are regarded as imported passenger luggage and are exempt from import duties and value-added tax;

③ Imported goods for personal use by Indonesian migrant workers are exempt from import duties.

The excitement continues in the next issue...