1667 Have consulted

Service introduction

关于泰国公司

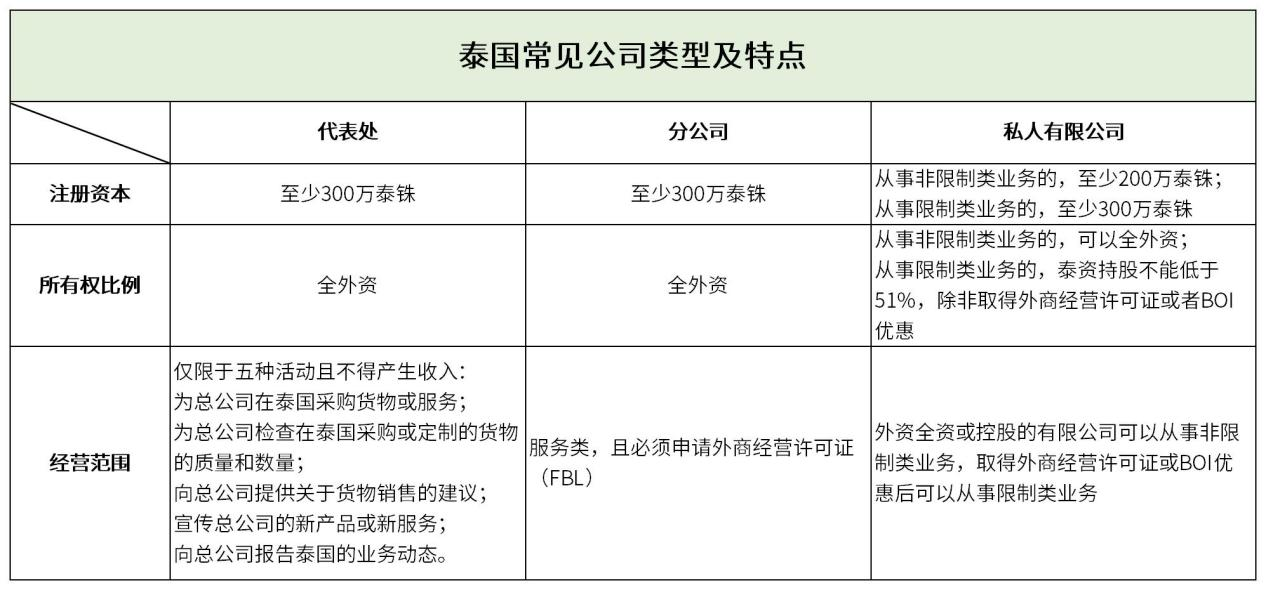

外国投资者到泰国投资,常见的组织形式有三种:代表处(representative office)、分公司(branch)和私人有限公司(private limited company)。

他们的主要特点如下:

泰国的【私人有限公司】类似中国的【有限责任公司】(同样是以公司其全部资产承担债务责任,每个股东也以其所认缴的出资额对公司承担有限责任,而且同样是股东和管理层分开),是泰国最常用,也是外国投资最普遍选择的公司形式。

熊猫出海泰国公司注册及相关服务

1、私人有限公司注册

1)确认经营范围、注册资本、股权结构和公司名字;

请注意,泰国规定私人有限公司的股东数量最少为3个,可以是自然人或法人。

2)我司协助准备泰国公司注册资料,包括代理委托协议、股东信息资料(法人股东营业执照、公司章程、董事会决议等,自然人股东身份信息、护照等)

3)必要资料的公证认证;

4)所有资料准备齐全后,我司将代客户办理预留公司名称、编写提交公司组织大纲、提交公司注册

所有资料准备齐全后,我司通常可在一周内完成泰国私人有限公司注册。

2、注册增值税

在泰国,任何有义务缴纳增值税的个人或实体必须在开业前或收入达到起征点后30天内注册成为增值税注册个人或实体。

如果企业位于曼谷,则必须向地区税务局提交注册申请;如果企业位于其他地方,则必须向地区税务分局提交注册申请。如果纳税人有多个分支机构,则必须向总部所在地的税务局提交注册申请。

所需材料:

1)PPO1

2)PP01.1

3)公司DBD全套文件

4)董事身份证复印件

5)经营场地产权证

6)产权证归属人身份证复印件

7)场地使用许可函

8)其他所需资料。

企业在申请增值税登记证时,需提交增值税登记证申请PP01和使用权益申请PP01.1(一式三份)

3、注册时商务部手续

1)如申请开发票、 工作证、 进出口权, 则必须办理, 办理耗时 10 个工

作日左右;

2)PP20 税务执照正式下来需要 1~2 个月左右,如需开 PP01 登记证证

明代替 PP20 税务执照使用加收一定的费用。

4、泰国海关进出口权登记开通

1)注册周期: 资料齐全 10 个工作日左右

*需要董事本人在泰国, 需要用到董事护照原件

5、开通银行账户

*需要董事本人到场

*开户周期: 资料齐全半天

*若需开通其他币种账户, 需另行计费。

6、注册社保

*不包含社保基金费用( 具体费用社保局会根据贵司情况进行评估)

*注册周期: 资料齐全 10 个工作日左右

*公司注册地址在曼谷, 非曼谷地区需另行报价

熊猫出海

为您定制一站式出海解决方案

① 投资咨询——找准企业出海方向

② 商务考察——实际掌握海外情况

③ 投资报告——确定企业落地策略

④ 建厂选址——选址选对事半功倍

⑤ 园区入驻——快速落地安全投产

⑥ 尽职调查——知己知彼百战不殆

⑦ 财法税合规——风险把控行稳致远

⑧ ODI境外投资备案——资金通道安全合规

⑨ 公司注册——专业团队便捷高效

⑩ 物流服务——专属定制跨境方案

关于熊猫出海

Southeast Asia business inspection

In order to help customers explore markets, seek business opportunities, and understand the economic situation, Panda Overseas tailors on-site inspection plans for companies that intend to carry out investment activities overseas, and provides comprehensive, refined, and customized inspection services to allow companies to conduct on-site inspections for customers. Conduct in-depth investigations and research on markets, suppliers, competitors, etc. to help companies make correct investment decisions. Service area:None

Overseas factory site selection|factory construction

Site selection is an important step before an enterprise actually puts into operation. The decision-making issue of site selection usually affects the enterprise's investment income, operating costs, tax policy preferences, sales channels, enterprise competitiveness, enterprise resource utilization, and the sustainable development of the enterprise, etc. Many aspects. Service area:None

BOI certificate application-Thailand

Applying for an "Investment Promotion License" from BOI is currently a favored way of investing in Thailand by Chinese-funded enterprises. Service area:Thailand

Monthly accounting and tax filing-Vietnam

Vietnam is a member of the World Trade Organization. Both domestic and foreign-funded enterprises adopt unified tax standards and implement different tax rates and exemption periods for projects in different fields. The main taxes in the current tax system are: corporate income tax, value-added tax, import and export tax, special sales tax, personal income tax, resource tax, agricultural land use tax, non-agricultural land use tax, environmental protection tax, property tax, stamp tax, and house tax. wait. Service area:Vietnam

"Compliance Management of "Going Global" Enterprises" Total 9 sections

Enterprises going overseas tax compliance Risk prevention solution

809 Learned ¥198.00

International engineering and labor tax practice sharing Total 9 sections

One Belt One Road Liang Hongxing international engineering

716 Learned ¥198.00

"Individual Income Tax Practices for Overseas Dispatched Personnel of "Going Global" Enterprises" Total 7 sections

go out Corporate overseas dispatch Personal Income Tax Practice

882 Learned ¥198.00

"Challenges and Responses to International Taxation for "Going Global" Enterprises—Cross-Border Taxation" Total 11 sections

go out corporate state tax Cross-border taxation

818 Learned ¥198.00

How to respond to tax audits in 2022? Total 8 sections

Responses tax inspection

813 Learned ¥30.00

Interpretation of tax incentives for investment in Southeast Asia Total 2 sections

Southeast Asia tax incentives Southeast Asia tax policy

788 Learned ¥30.00

Land holding restrictions for foreign-funded enterprises investing in Southeast Asia Total 1 sections

Southeast Asia Investment Overseas property purchase

898 Learned ¥30.00

2024 Southeast Asia E-commerce Market Insights Report

Free

In-depth Insight Report on the Globalization of Chinese Enterprises: Southeast Asia

Free

United Nations: World Investment Report 2024

Free

State Administration of Taxation: Tax Guidelines for “Going Global” (Revised Version 2024)

Free

In-depth Insight Report on the Globalization of Chinese Enterprises - Industry

Free

Overview of China's overseas investment in the first half of 2024

Free

China's Outward Investment and Cooperation Development Report 2023·Ministry of Commerce

Free

Overview of China’s Overseas Investment in 2023

Free