Southeast Asia business inspection

In order to help customers explore markets, seek business opportunities, and understand the economic situation, Panda Overseas tailors on-site inspection plans for companies that intend to carry out investment activities overseas, and provides comprehensive, refined, and customized inspection services to allow companies to conduct on-site inspections for customers. Conduct in-depth investigations and research on markets, suppliers, competitors, etc. to help companies make correct investment decisions. Service area:None

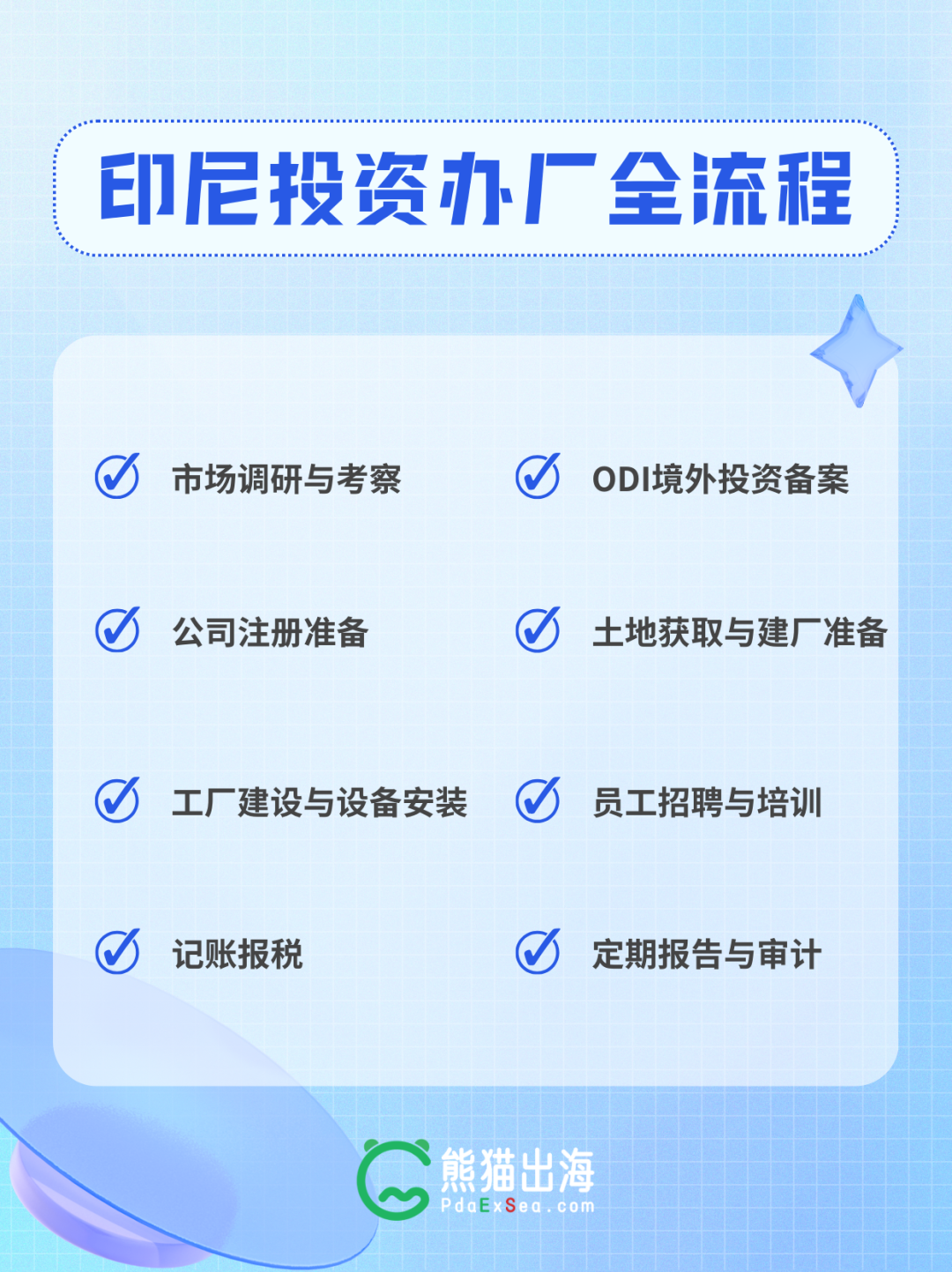

Overseas factory site selection|factory construction

Site selection is an important step before an enterprise actually puts into operation. The decision-making issue of site selection usually affects the enterprise's investment income, operating costs, tax policy preferences, sales channels, enterprise competitiveness, enterprise resource utilization, and the sustainable development of the enterprise, etc. Many aspects. Service area:None

BOI certificate application-Thailand

Applying for an "Investment Promotion License" from BOI is currently a favored way of investing in Thailand by Chinese-funded enterprises. Service area:Thailand

Monthly accounting and tax filing-Vietnam

Vietnam is a member of the World Trade Organization. Both domestic and foreign-funded enterprises adopt unified tax standards and implement different tax rates and exemption periods for projects in different fields. The main taxes in the current tax system are: corporate income tax, value-added tax, import and export tax, special sales tax, personal income tax, resource tax, agricultural land use tax, non-agricultural land use tax, environmental protection tax, property tax, stamp tax, and house tax. wait. Service area:Vietnam

"Compliance Management of "Going Global" Enterprises" Total 9 sections

1968 Learned ¥198.00

International engineering and labor tax practice sharing Total 9 sections

1664 Learned ¥198.00

"Individual Income Tax Practices for Overseas Dispatched Personnel of "Going Global" Enterprises" Total 7 sections

2009 Learned ¥198.00

"Challenges and Responses to International Taxation for "Going Global" Enterprises—Cross-Border Taxation" Total 11 sections

1753 Learned ¥198.00

How to respond to tax audits in 2022? Total 8 sections

1849 Learned ¥30.00

Interpretation of tax incentives for investment in Southeast Asia Total 2 sections

1773 Learned ¥30.00

Land holding restrictions for foreign-funded enterprises investing in Southeast Asia Total 1 sections

1872 Learned ¥30.00

Tax Guide for Chinese Residents Investing in Indonesia 2024 Edition

Free

Tax Guide for Chinese Residents Investing in Cambodia 2024 Edition

Free

Tax Guide for Chinese Residents Investing in Vietnam 2024 Edition

Free

Tax Guide for Chinese Residents Investing in Thailand 2024

Free

Tax Guide for Mainland Chinese Residents Investing in the Hong Kong Special Administrative Region (2024 Edition)

Free

2024 Southeast Asia E-commerce Market Insights Report

Free

In-depth Insight Report on the Globalization of Chinese Enterprises: Southeast Asia

Free

United Nations: World Investment Report 2024

Free